What the Future Holds for Gen Z and Millennials

Yesterday, I talked about a group I’ve seen more and more of lately, people heading toward retirement who are still renting, still moving, still searching for security in the later chapters of life.

But what about the generations coming up behind them?

What happens when the tenants of today become the pensioners of tomorrow?

For Millennials and Gen Z here in Reading, the journey to owning a home looks less like a ladder and more like a maze. It’s not just harder. It’s fundamentally different. The choices people are making now, in their 20s, 30s and 40s, will shape what kind of future they’ll have, not just financially, but emotionally, practically, and even socially.

The Dream Is Still There—But It's Slipping Further Away

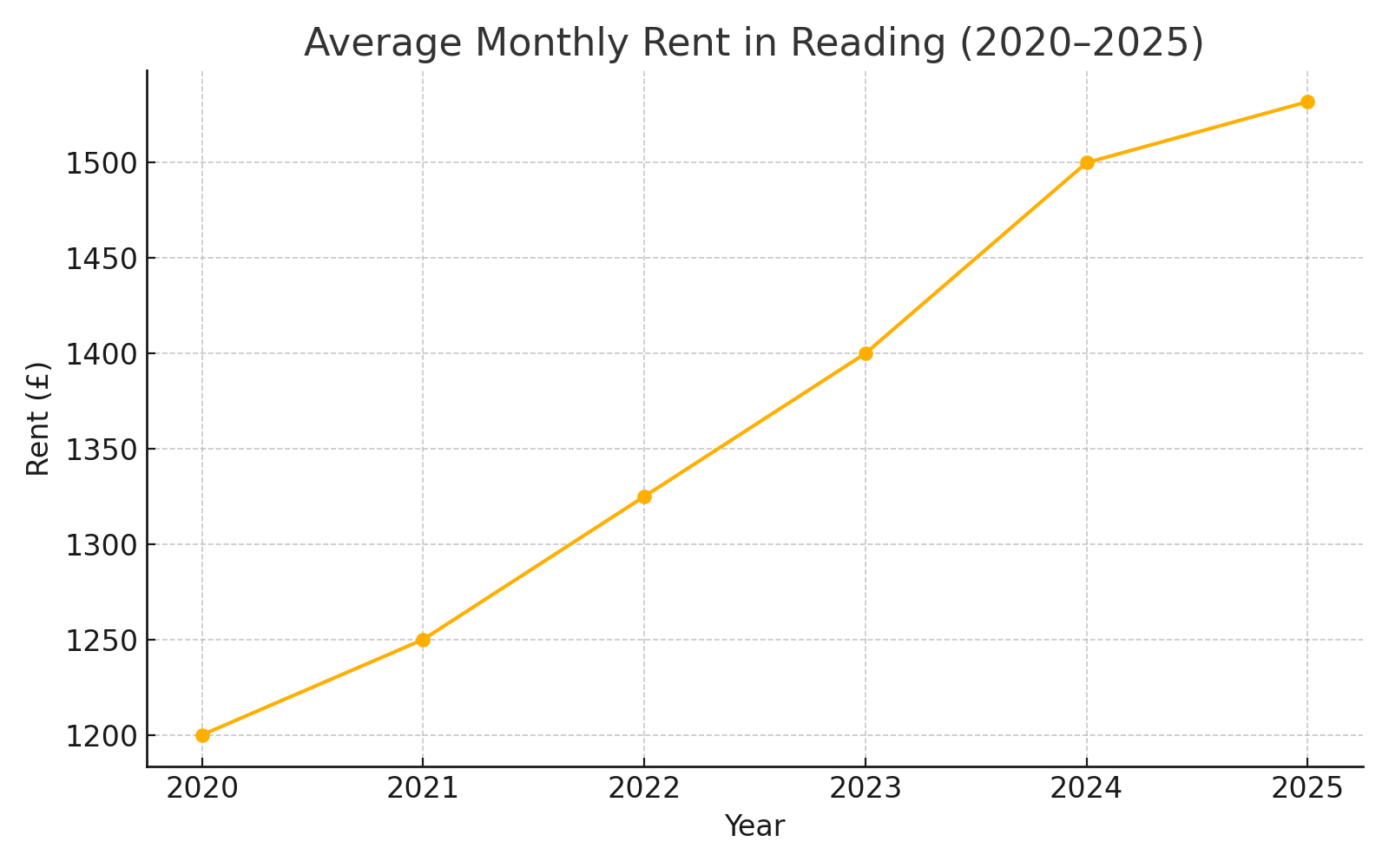

Rents in Reading have risen over 25% in five years — putting added pressure on would-be first-time buyers.

Let’s be honest. Most young people still want to own a home. That hasn’t changed. But the reality they’re facing is worlds apart from what their parents dealt with. Property prices have outpaced wages, rental costs swallow up any chance of saving, and mortgage rules are tougher than ever.

In Reading, I’m regularly seeing first-time buyer deposits creeping past £50,000. That’s if you can even find a property that makes sense for your lifestyle and budget. Monthly rents of £1,500 or more aren’t unusual now, which makes saving feel like trying to fill a bath with the plug out.

And so, we see more people relying on the Bank of Mum and Dad - or quietly giving up altogether.

When Inheritance Shapes the Market

But here’s where things get even more complicated.

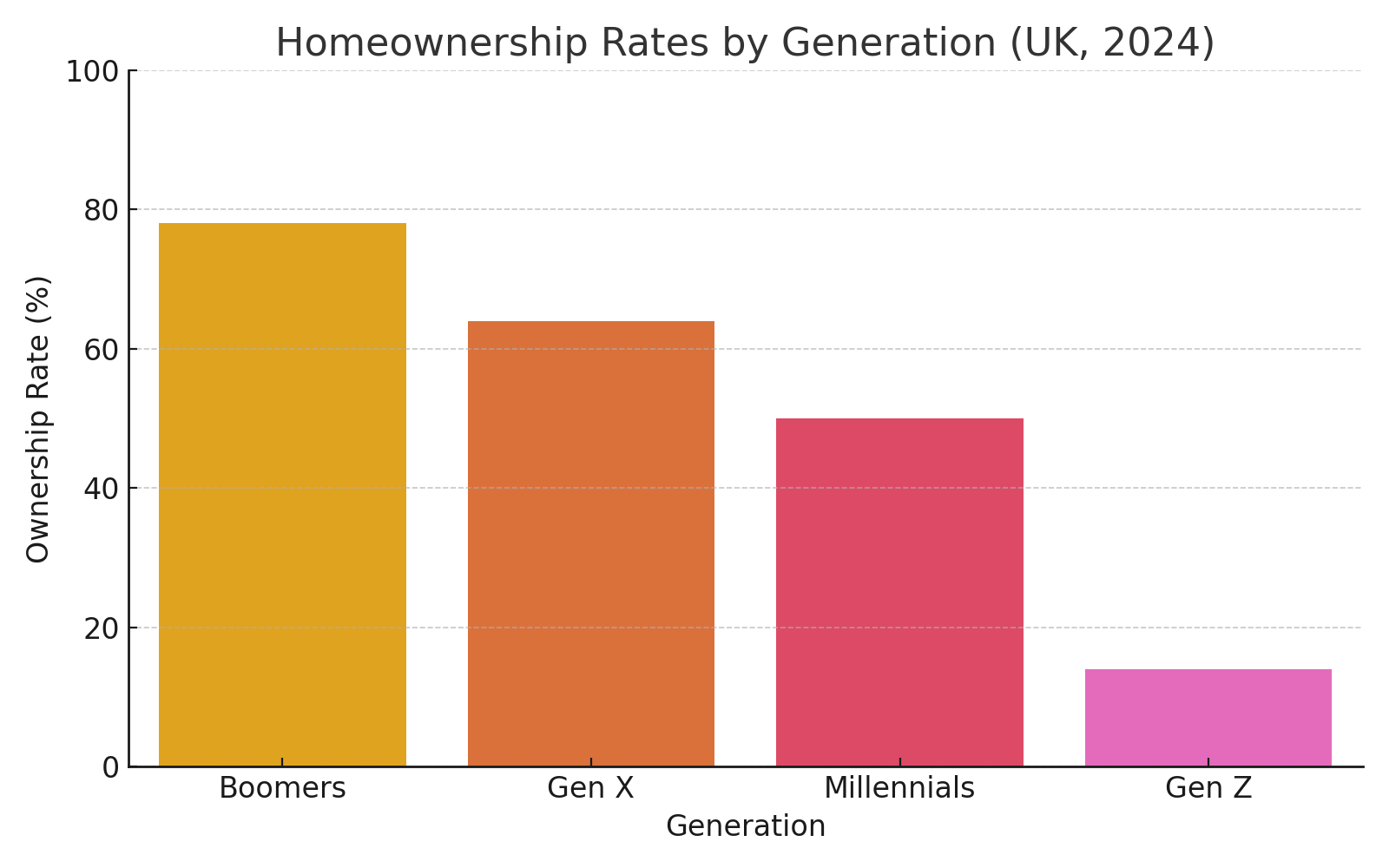

For some, the only real hope of stepping onto the ladder is inheritance. That might sound blunt, but it’s true. We’re already seeing a divide between those who’ll eventually inherit a home and those who won’t. It’s not about work ethic or ambition. It’s about whether your family owns a property now.

And what that’s creating is a two-speed property market: one for those with assets behind them, and one for those without. The implications of that, especially in a place like Reading, are huge.

Gen Z’s homeownership rate is just 14% — highlighting a major generational divide.

Gen Z Are Flipping the Script

Interestingly, I’m also seeing a growing number of younger people rethinking the whole idea of homeownership entirely. Not giving up on it, but flipping it on its head.

They’re renting here in Reading, where the jobs and lifestyle are, but buying somewhere else. Somewhere cheaper. Somewhere they don’t plan to live, but that they can rent out. They’re becoming landlords before they ever become homeowners. For them, property isn’t necessarily about a forever home anymore, it’s an asset, a strategy, a safety net.

And it’s changing the shape of our local market in quiet but meaningful ways.

Reading’s Market Will Have to Adapt

What does this all mean? Well, we’re likely to see more families stepping in to help with deposits. We’ll see more co-living spaces, more shared ownership, more flexible homes designed for the way people actually live now, not the way we lived fifty years ago.

And at the same time, rental stock will be under pressure. Older tenants are staying put, and younger ones are piling in. That squeezes supply and changes expectations -on both sides of the market.

So What Needs to Change?

If we don’t address this properly, we risk repeating the same cycle - just with a different generation.

We need clearer routes into ownership for those who can afford the repayments but can’t get past the upfront barriers. We need tenancy agreements that reflect the fact some people will rent for life. And we need to rethink what we build, how we build it, and who it’s really for.

Because this isn’t just a social issue. It’s a market one.

Potential Solutions for Gen Z and Millennials

-

Affordable Housing Initiatives: Advocate for local authorities to prioritise the construction of affordable housing units tailored for first-time buyers.

-

Financial Education Programs: Implement programs that offer financial literacy education, empowering younger individuals to better manage savings and understand mortgage processes.

-

Incentives for First-Time Buyers: Government-backed incentives, such as tax breaks or reduced stamp duty, can alleviate financial burdens and encourage ownership.

-

Promotion of Co-Living Models: Support the development of co-living arrangements and alternative housing models that offer affordable, flexible options suited to modern living.

Final Thought

The signs are already here.

“Rentirement” isn’t just a future risk -it’s already forming among Millennials and Gen Z.

Without bold action and smarter housing solutions, we may soon be asking:

Is a lifetime of renting becoming the new normal in Reading?

If you’re trying to find your way forward—whether it’s buying your first place, selling something bigger, or planning for the future—I’d love to help.

–

Mark Heneghan, Bespoke Estate Agents

Require a Conveyancing Solicitor?

For an even smoother moving experience, we can introduce you to our network of trusted conveyancing solicitors. For a no-obligation introduction and Bespoke conveyancing quote, click below.

Bespoke ConveyancingRead What Our

Customers Say

Discover the true value of your property with the top estate agents in Reading.

Unlock the potential of your property with a CONFIDENTIAL, FREE, NO-OBLIGATION valuation and marketing consultation from Reading’s top estate agents. Our experienced property experts provide an accurate assessment tailored to current market trends, ensuring you’re informed and confident in your next steps. Don’t just wonder—discover what your property is truly worth with a trusted team dedicated to helping you maximize value

Book a Valuation